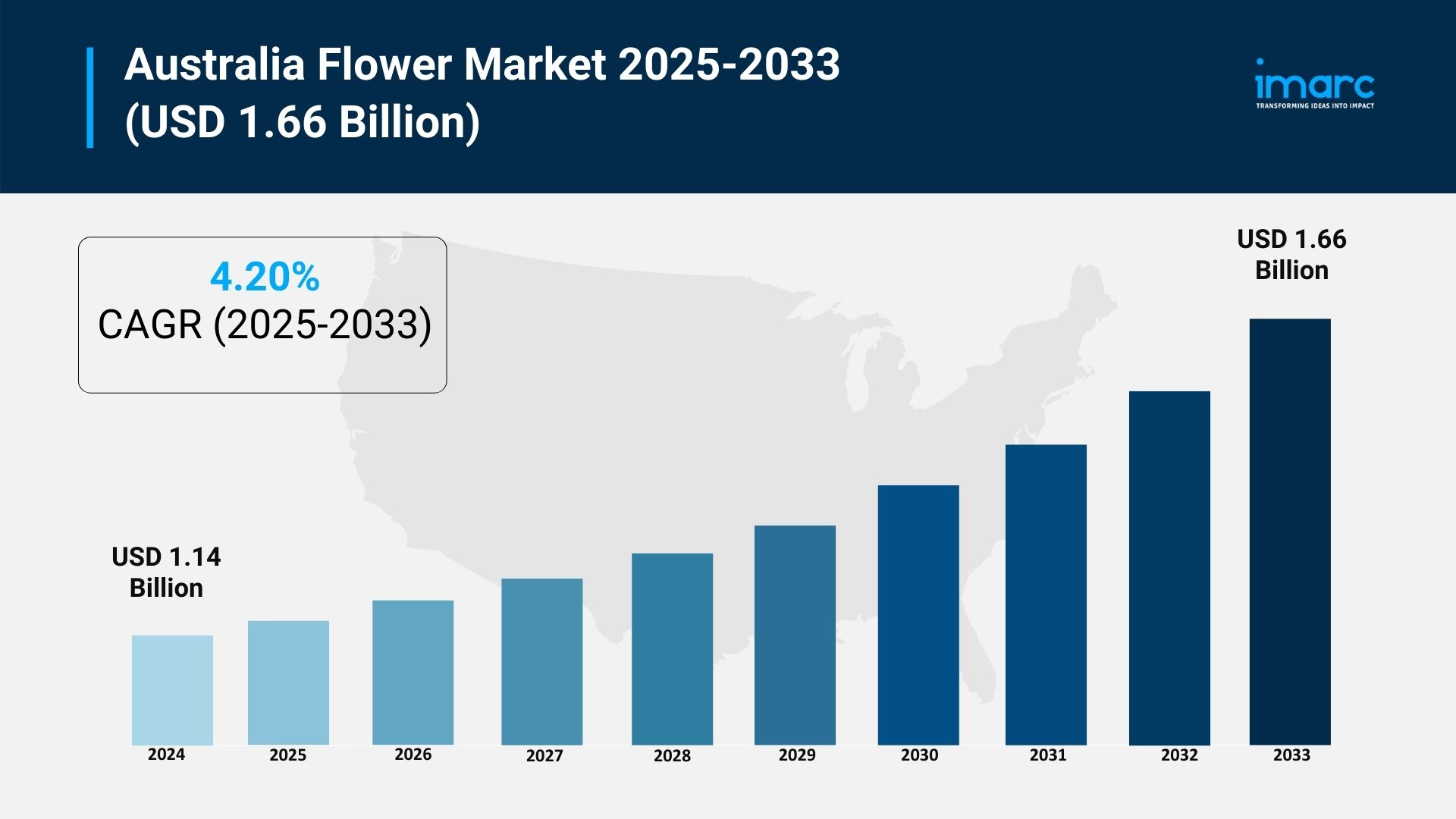

The latest report by IMARC Group, titled “Australia Flower Market Report by Product Type (Fresh Cut Flowers, Potted Plants and Indoor Flowers, Dried and Artificial Flowers), Application (Personal Use, Corporate Use, Events and Weddings, Religious Ceremonies, Gifting), Distribution Channel (Online Retail, Offline Retail), and Region 2025-2033,” offers a comprehensive analysis of the Australia flower market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia flower market size reached USD 1.14 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.66 Billion by 2033, exhibiting a CAGR of 4.20% during 2025–2033.

Base Year: 2024

Forecast Years: 2025–2033

Historical Years: 2019–2024

Market Size in 2024: USD 1.14 Billion

Market Forecast in 2033: USD 1.66 Billion

Market Growth Rate (2025–2033): 4.20%

Australia Flower Market Overview

Australia’s thriving flower market is blossoming into a global leader, driven by the surging demand for premium, sustainable, and locally sourced blooms. From native exports like kangaroo paw and banksia to the booming popularity of indoor floral décor and gifting, the sector is perfectly aligned with modern consumer values—sustainability, personalization, and digital convenience.

With strong government backing, growing international interest, and investments in cold chain logistics and AI-powered delivery platforms, the market is ripe with opportunity. Whether it’s through immersive floriculture tourism or high-end custom floral services, Australia is uniquely positioned to capitalize on global floriculture trends while preserving its rich botanical heritage and biodiversity.

Request For Sample Report:

https://www.imarcgroup.com/australia-flower-market/requestsample

Australia Flower Market Trends

- Sustainability and eco-friendly practices: Significant industry shift toward locally grown, pesticide-free, and organically farmed flowers responding to 89% of Australians considering sustainable lifestyles important, with native species adoption reducing environmental impact and water consumption.

- E-commerce and digital transformation: Revolutionary expansion of online flower delivery services with 63.94% of Australia’s population (17.08 million people) actively shopping online, representing 45% increase since 2020 and driving same-day delivery and customization features.

- Cultural and festive demand acceleration: Strong consumer association between flowers and special occasions including Valentine’s Day, Mother’s Day, weddings, and corporate events generating consistent sales peaks and year-round consumption patterns.

- Home aesthetics and interior décor integration: Growing consumer preference for incorporating fresh flowers into daily home décor driven by social media inspiration and wellness trends creating habitual consumption patterns beyond occasional purchases.

- Native and exotic variety appreciation: Increasing domestic and international demand for Australian native flowers including kangaroo paw, banksia, and waratah offering unique appearance, extended vase life, and climate adaptability supporting export market growth.

- Premium and niche segment development: Expanding high-end consumer demand for custom floral arrangements, bespoke services, and artistic designs in metropolitan areas creating opportunities for specialty florists and luxury market positioning.

Market Drivers

- Consumer lifestyle evolution: Rising interest in home aesthetics and wellness driving incorporation of fresh flowers into daily living spaces as lifestyle accessories transforming floristry from occasional to habitual consumption patterns.

- Cultural celebration traditions: Strong cultural embedding of flowers in milestone events, celebrations, and emotional expressions ensuring dependable customer base across demographics and maintaining resilient demand during economic fluctuations.

- Digital platform expansion: Rapid growth of online shopping preferences with AI and machine learning integration enabling personalized bouquet tools, automated delivery updates, and enhanced customer satisfaction supporting market accessibility and convenience.

- Export market opportunities: Growing international appreciation for Australian native flower species across Asia, Europe, and North America markets driven by unique appearance, sustainability credentials, and premium positioning potential.

- Government sustainability support: Policy initiatives supporting biodiversity conservation, eco-friendly agriculture practices, and local cultivation creating favorable conditions for sustainable floriculture development and environmental responsibility adoption.

- Tourism and experience economy: Expanding floriculture tourism sector through flower festivals, agri-tourism experiences, and educational events creating additional revenue streams and fostering long-term consumer engagement with floral industry.

Challenges and Opportunities

Challenges:

- Supply chain inefficiencies across Australia’s vast landmass creating logistical challenges for transporting fresh flowers from rural production zones to urban centers, requiring expensive cold chain infrastructure and increasing final retail prices

- Climate change vulnerabilities including heatwaves, droughts, bushfires, and erratic rainfall patterns disrupting planting schedules, reducing crop yields, and requiring costly protective infrastructure investments for climate adaptation

- Import competition pressure from low-cost producing countries like Kenya, Colombia, and the Netherlands offering flowers at significantly lower prices through economies of scale and established global supply chains

- Post-harvest quality maintenance challenges requiring advanced cold storage, transportation, and handling systems to preserve freshness and extend shelf life throughout distribution networks and retail channels

- Seasonal demand fluctuations creating inventory management difficulties, supply planning complexities, and resource allocation challenges for growers and retailers managing peak and off-peak consumption periods

Opportunities:

- Premium market expansion targeting high-end consumers seeking custom floral arrangements, rare varieties, and bespoke design services in metropolitan areas offering higher profit margins and brand differentiation potential

- Export market development leveraging Australian native flower species uniqueness and sustainability credentials to serve international markets seeking distinctive floral products and environmentally responsible sourcing

- Technological innovation integration implementing advanced post-harvest management systems, AI-powered customization platforms, and sustainable production methods improving efficiency and competitive positioning

- Floriculture tourism growth developing flower festivals, agri-tourism experiences, and educational programs creating additional revenue streams and strengthening consumer connections with local flower industry

- Sustainable agriculture leadership adopting organic farming practices, biodegradable packaging, and native species cultivation meeting consumer demand for environmentally responsible products and supporting conservation goals

Australia Flower Market Segmentation

By Product Type:

- Fresh Cut Flowers

- Potted Plants and Indoor Flowers

- Dried and Artificial Flowers

By Application:

- Personal Use

- Corporate Use

- Events and Weddings

- Religious Ceremonies

- Gifting

By Distribution Channel:

- Online Retail

- Offline Retail

By Region:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-flower-market

Australia Flower Market News (2024–2025)

- 2024: Sustainable floriculture practices accelerated with 89% of Australians prioritizing sustainable lifestyles, driving demand for locally grown, pesticide-free flowers and native species adoption including kangaroo paw, waratah, and waxflower requiring fewer resources.

- 2024: E-commerce expansion reached new heights with 63.94% of Australia’s population (17.08 million people) actively shopping online, representing 45% growth since 2020 and transforming flower delivery services through same-day delivery and AI-powered customization.

- 2024: Native flower export demand increased significantly with international markets in Asia, Europe, and North America appreciating Australian species uniqueness, sustainability credentials, and extended vase life characteristics creating premium positioning opportunities.

- 2024: Floriculture tourism festivals including Toowoomba Carnival of Flowers and Floriade in Canberra expanded visitor engagement, promoting regional tourism while providing direct consumer access for local growers through markets and exhibitions.

- 2024: Technological advancements in post-harvest management improved including vacuum cooling, modified atmosphere packaging, and enhanced cold chain logistics extending flower shelf life and supporting export market competitiveness.

Key Highlights of the Report

- Market Performance (2019–2024)

- Market Outlook (2025–2033)

- Industry Catalysts and Challenges

- Segment-wise historical and future forecasts

- Competitive Landscape and Key Player Analysis

- Product Type, Application, and Distribution Channel Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=35793&flag=F

Q&A Section

Q1: What drives growth in the Australia flower market?

A1: Market growth is driven by rising consumer demand for premium sustainable floral products, expanding online retail channels offering convenience and customization, increasing home aesthetics integration creating habitual consumption, strong cultural celebration traditions ensuring consistent demand, export opportunities for native flower species, and government support for eco-friendly cultivation practices.

Q2: What are the latest trends in this market?

A2: Key trends include sustainability and eco-friendly practices adoption with native species preference, e-commerce digital transformation enabling personalized shopping experiences, cultural and festive demand acceleration across celebrations, home aesthetics integration driven by social media inspiration, native and exotic variety appreciation supporting export growth, and premium niche segment development targeting luxury consumers.

Q3: What challenges do companies face?

A3: Major challenges include supply chain inefficiencies across Australia’s vast geography requiring expensive cold chain infrastructure, climate change vulnerabilities affecting crop yields and quality, import competition from low-cost international producers, post-harvest quality maintenance requiring advanced storage systems, and seasonal demand fluctuations creating inventory management complexities.

Q4: What opportunities are emerging?

A4: Emerging opportunities include premium market expansion for custom floral services targeting high-end consumers, export market development leveraging native species uniqueness for international sales, technological innovation integration improving efficiency and competitiveness, floriculture tourism growth creating additional revenue streams, and sustainable agriculture leadership meeting environmental responsibility demands.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302