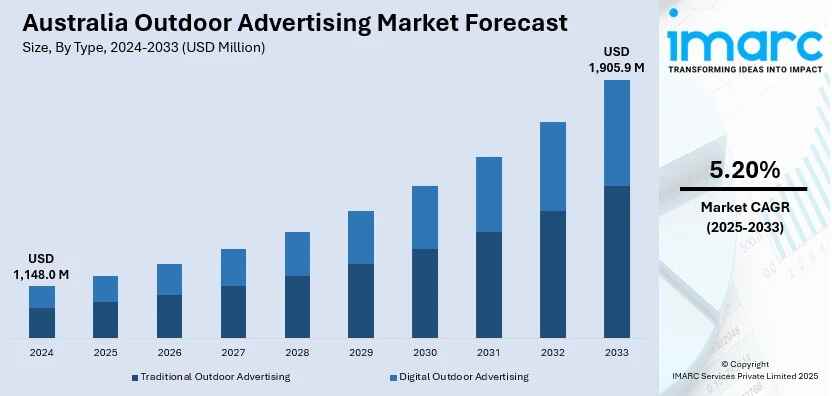

The latest report by IMARC Group, titled “Australia Outdoor Advertising Market Report by Type (Traditional Outdoor Advertising, Digital Outdoor Advertising), Segment (Billboard Advertising, Transport Advertising, Street Furniture Advertising, Others), and Region 2025-2033,” offers a comprehensive analysis of the Australia outdoor advertising market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia outdoor advertising market size reached USD 1,148.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,905.9 Million by 2033, exhibiting a CAGR of 5.20% during 2025-2033.

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 1,148.0 Million

Market Forecast in 2033: USD 1,905.9 Million

Market Growth Rate (2025-2033): 5.20%

Australia Outdoor Advertising Market Overview

The Australia outdoor advertising market is experiencing steady growth driven by regional expansion beyond metropolitan centers, increasing digital innovation through programmatic platforms and 3D displays, strengthening urban mobility creating high-traffic exposure opportunities, advancing digital out-of-home (DOOH) technology, and growing integration with mobile and digital platforms enabling interactive engagement. The market expansion is supported by technological advancements in real-time targeting capabilities, data-driven campaign optimization, automated content delivery systems, and increasing recognition of outdoor advertising’s uninterrupted brand exposure advantages, visual dominance impact, and measurable performance through integrated analytics. Advanced outdoor advertising solutions are transforming Australia’s marketing landscape through strategic location targeting including airports, rail stations, and cruise terminals, multicultural engagement campaigns, eco-friendly sustainable practices, and event-based activations positioning outdoor advertising as essential omnichannel marketing component delivering high-frequency exposure and strong brand recall.

Australia’s outdoor advertising foundation demonstrates strong infrastructure fundamentals across diverse applications including billboard campaigns, transport advertising networks, street furniture placements, event promotions, tourism marketing, and retail brand visibility initiatives. The country’s urbanization trends, extensive public transportation networks, growing regional connectivity, and sophisticated consumer mobility patterns create substantial demand for outdoor advertising solutions capable of delivering wide audience reach, strategic geographic targeting, and consistent message reinforcement. The proliferation of digital billboards constituting over 76% of total OOH revenue in Q2 2024, programmatic advertising adoption, mobile integration features including QR codes and NFC technology, and regional expansion initiatives launching 126+ new sites is creating favorable market conditions, requiring significant investments in digital infrastructure, data analytics capabilities, sustainable energy solutions, and creative content development. Australia’s diverse multicultural demographics combined with strong event culture and international tourism appeal make it an increasingly important market for innovative outdoor advertising development and comprehensive brand visibility strategies supporting advertiser objectives and measurable marketing outcomes.

Request For Sample Report:

https://www.imarcgroup.com/australia-outdoor-advertising-market/requestsample

Australia Outdoor Advertising Market Trends

- Regional expansion acceleration: Growing investment beyond metropolitan centers targeting high-traffic zones across airports including Hobart and Launceston, rail stations through Australian Rail Track Corporation partnerships, cruise terminals like Port of Airlie, and regional NSW locations capturing broader consumer segments.

- Digital OOH dominance: Increasing digital outdoor advertising adoption achieving 76%+ revenue share with programmatic capabilities, real-time content delivery, dynamic targeting based on demographics, weather, traffic flow, and time-of-day optimization improving campaign effectiveness and measurability.

- International campaign execution: Expanding cross-border marketing initiatives including Tourism Australia campaigns in Delhi NCR and Mumbai targeting affluent consumers in airports, malls, and corporate hubs promoting Australian destinations, education, and banking services globally.

- Mobile integration advancement: Strengthening interactive features incorporating QR codes, NFC-enabled signage, geolocation triggers, and smartphone connectivity driving immediate actions including app downloads, website visits, and purchases while generating valuable audience behavior insights.

- Sustainable practices adoption: Rising implementation of eco-friendly solutions including energy-efficient LED signage, solar-powered billboards, biodegradable materials, and recyclable print media aligning with consumer environmental expectations and regulatory support for green initiatives.

- Event-focused activations: Growing investment around festivals, sports tournaments, and cultural exhibitions utilizing temporary installations, branded environments, pop-up billboards, and event-specific signage generating buzz and enhancing relevance during high-attendance occasions.

Market Drivers

- Urban mobility surge: Implementation of extensive public transportation networks including train stations, bus stops, airports, and retail hubs creating continuous consumer exposure to outdoor advertisements reaching wide diverse audiences particularly effective where digital distractions are limited.

- Programmatic technology advancement: Growing digital out-of-home platform capabilities enabling real-time targeting, automated content delivery, dynamic messaging based on data inputs, and performance tracking making outdoor advertising measurable, accountable, and attracting broader advertiser segments.

- Visual impact dominance: Increasing effectiveness of large-format billboards, transit ads, and building wraps commanding attention through scale, permanence, and creative flexibility offering uninterrupted exposure ensuring brand messages are seen repeatedly building strong recall.

- Regional infrastructure development: Expanding connectivity improvements, strategic location availability, and local government recognition of regional visibility value capturing underserved consumer segments supporting intra-state travel growth and regional tourism expansion.

- Cross-platform integration: Strengthening omnichannel marketing strategies blending offline outdoor exposure with online digital engagement through mobile connectivity, social media linkage, and data analytics creating seamless consumer experiences and comprehensive campaign measurement.

- Event culture strength: Growing calendar of festivals, sports tournaments, and cultural exhibitions attracting large diverse crowds providing brands opportunities for impactful real-time engagement through well-placed strategic advertising generating immediate visibility and memorability.

Challenges and Opportunities

Challenges:

- Regulatory compliance complexities involving local council approvals, content restrictions, placement limitations, and varying state regulations creating administrative burdens, approval delays, and operational constraints particularly affecting regional expansion initiatives and innovative format deployments

- Measurement standardization difficulties quantifying audience reach, engagement levels, and campaign effectiveness compared to digital media requiring industry-wide adoption of consistent metrics, third-party verification systems, and transparent reporting methodologies building advertiser confidence

- Weather and environmental exposure risks including billboard damage from storms, cyclones, bushfires, and extreme heat requiring durable materials, regular maintenance, structural reinforcements, and insurance coverage affecting operational costs and asset longevity particularly in vulnerable regions

- Creative content limitations involving static format constraints, message simplicity requirements, brief viewing times, and environmental context considerations requiring skilled design capabilities, concise messaging, and location-appropriate creative executions maximizing impact within physical constraints

- Market fragmentation challenges with multiple operators, varying technology standards, inconsistent data integration, and limited programmatic connectivity creating buying complexity, campaign coordination difficulties, and inefficiencies compared to centralized digital advertising platforms

Opportunities:

- 3D display innovation developing immersive visual experiences, depth-perception effects, attention-grabbing formats, and memorable brand activations differentiating advertisers and commanding premium pricing through cutting-edge technology installations in high-visibility urban locations

- Programmatic ecosystem expansion building integrated platforms connecting inventory across operators, enabling automated buying, real-time bidding, audience-based targeting, and centralized campaign management simplifying advertiser access and improving market efficiency

- Regional tourism partnerships collaborating with destination marketing organizations, accommodation providers, attraction operators, and event organizers creating co-branded campaigns, seasonal promotions, and visitor engagement initiatives supporting regional economic development

- Data analytics integration leveraging mobile tracking, demographic profiling, traffic pattern analysis, and consumer behavior insights informing site selection, content optimization, campaign timing, and performance measurement demonstrating ROI and attribution capabilities

- Multicultural targeting development creating language-specific campaigns, culturally relevant messaging, ethnic media partnerships, and community-focused placements engaging Australia’s diverse population segments including Asian, Pacific Islander, and Middle Eastern communities

Australia Outdoor Advertising Market Segmentation

By Type:

- Traditional Outdoor Advertising

- Static Billboards

- Printed Posters

- Painted Signs

- Vinyl Graphics

- Traditional Transit Ads

- Classic Street Furniture

- Digital Outdoor Advertising

- Digital Billboards

- LED Screens

- Digital Transit Displays

- Interactive Kiosks

- Digital Street Furniture

- Programmatic DOOH

By Segment:

- Billboard Advertising

- Roadside Billboards

- Highway Signage

- Urban Billboards

- Regional Billboards

- Premium Locations

- Landmark Sites

- Transport Advertising

- Train Station Advertising

- Airport Advertising

- Bus Shelter Advertising

- Transit Vehicle Wraps

- Taxi/Rideshare Advertising

- Ferry Terminal Advertising

- Street Furniture Advertising

- Bus Shelters

- Public Benches

- Kiosks

- Public Toilets

- Information Panels

- Pedestrian Infrastructure

- Others

- Building Wraps

- Mobile Billboards

- Stadium Advertising

- Retail Site Advertising

- Event Activations

- Experiential Installations

By Region:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-outdoor-advertising-market

Australia Outdoor Advertising Market News (2024-2025)

- September 2025: Research indicated billboard advertising integrated with digital marketing increased campaign performance by 23%, boosting click-through rates and reducing cost-per-acquisition across channels demonstrating outdoor advertising’s omnichannel effectiveness.

- March 2025: Wildstone acquired Total Outdoor Media’s entire regional billboard portfolio in Victoria marking first major acquisition in Australian market, expanding footprint and demonstrating consolidation trends in regional outdoor advertising sector.

- December 2024: Bishopp Outdoor Advertising launched 126 new OOH sites including 14 digital units across Australia, establishing partnerships with Hobart and Launceston airports, Port of Airlie cruise terminal, and Australian Rail Track Corporation covering nearly 100 regional NSW locations.

- April 2025: Tourism Australia executed three-week OOH campaign across Delhi NCR and Mumbai featuring digital screens, large-format billboards, and mall facades showcasing “The view’s even better down under” targeting affluent Indian consumers.

- Q2 2024: OOH industry experienced 19.36% revenue lift with Digital OOH accounting for over 76% of total revenue demonstrating strong digital format adoption and programmatic advertising growth across Australian outdoor advertising market.

- 2025: Gawk Outdoor announced new digital billboard launches in regional locations including Leeton scheduled for September 2025, reflecting ongoing investment in regional digital infrastructure expansion supporting advertiser demand for non-metropolitan reach.

Key Highlights of the Report

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- Industry Catalysts and Challenges

- Segment-wise historical and future forecasts

- Competitive Landscape and Key Player Analysis

- Type and Segment Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=32279&flag=F

Q&A Section

Q1: What drives growth in the Australia outdoor advertising market?

A1: Market growth is driven by urban mobility surge with extensive public transportation networks creating continuous consumer exposure, programmatic technology advancement enabling real-time targeting and measurable campaigns, visual impact dominance through large-format placements offering uninterrupted brand exposure, regional infrastructure development expanding connectivity and strategic locations, cross-platform integration blending offline and online engagement through mobile connectivity, and event culture strength providing high-attendance opportunities for impactful brand visibility during festivals and tournaments.

Q2: What are the latest trends in this market?

A2: Key trends include regional expansion acceleration targeting airports, rail stations, and regional NSW locations beyond metropolitan centers, digital OOH dominance achieving 76%+ revenue share with programmatic capabilities, international campaign execution including Tourism Australia initiatives in India targeting global audiences, mobile integration advancement incorporating QR codes and NFC enabling immediate actions, sustainable practices adoption using LED signage and solar-powered billboards, and event-focused activations utilizing temporary installations during cultural occasions.

Q3: What challenges do companies face?

A3: Major challenges include regulatory compliance complexities involving local approvals and varying state regulations creating operational constraints, measurement standardization difficulties quantifying audience reach compared to digital media, weather and environmental exposure risks requiring durable materials and maintenance, creative content limitations involving static formats and brief viewing times, and market fragmentation challenges with multiple operators and inconsistent technology standards creating buying complexity.

Q4: What opportunities are emerging?

A4: Emerging opportunities include 3D display innovation creating immersive visual experiences commanding premium pricing, programmatic ecosystem expansion building integrated platforms enabling automated buying and centralized management, regional tourism partnerships creating co-branded campaigns supporting economic development, data analytics integration leveraging mobile tracking and traffic pattern analysis demonstrating ROI, and multicultural targeting development creating language-specific campaigns engaging Australia’s diverse population segments.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302